VIRTUAL RESEARCH

Shelf tests in a simulated virtual shelf shop aim to evaluate the effectiveness of product placement and packaging design. Here are some common metrics you might consider in such tests:

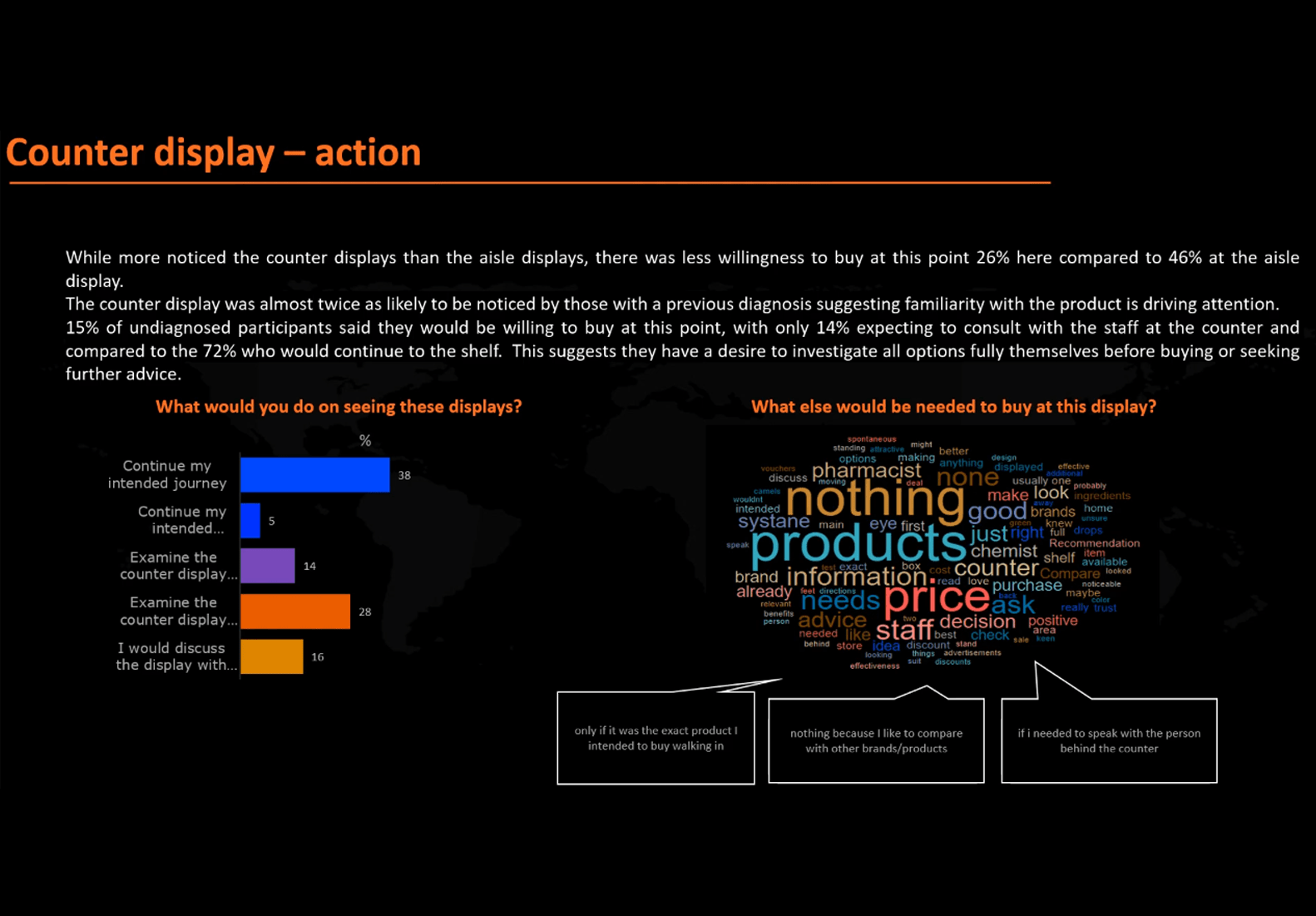

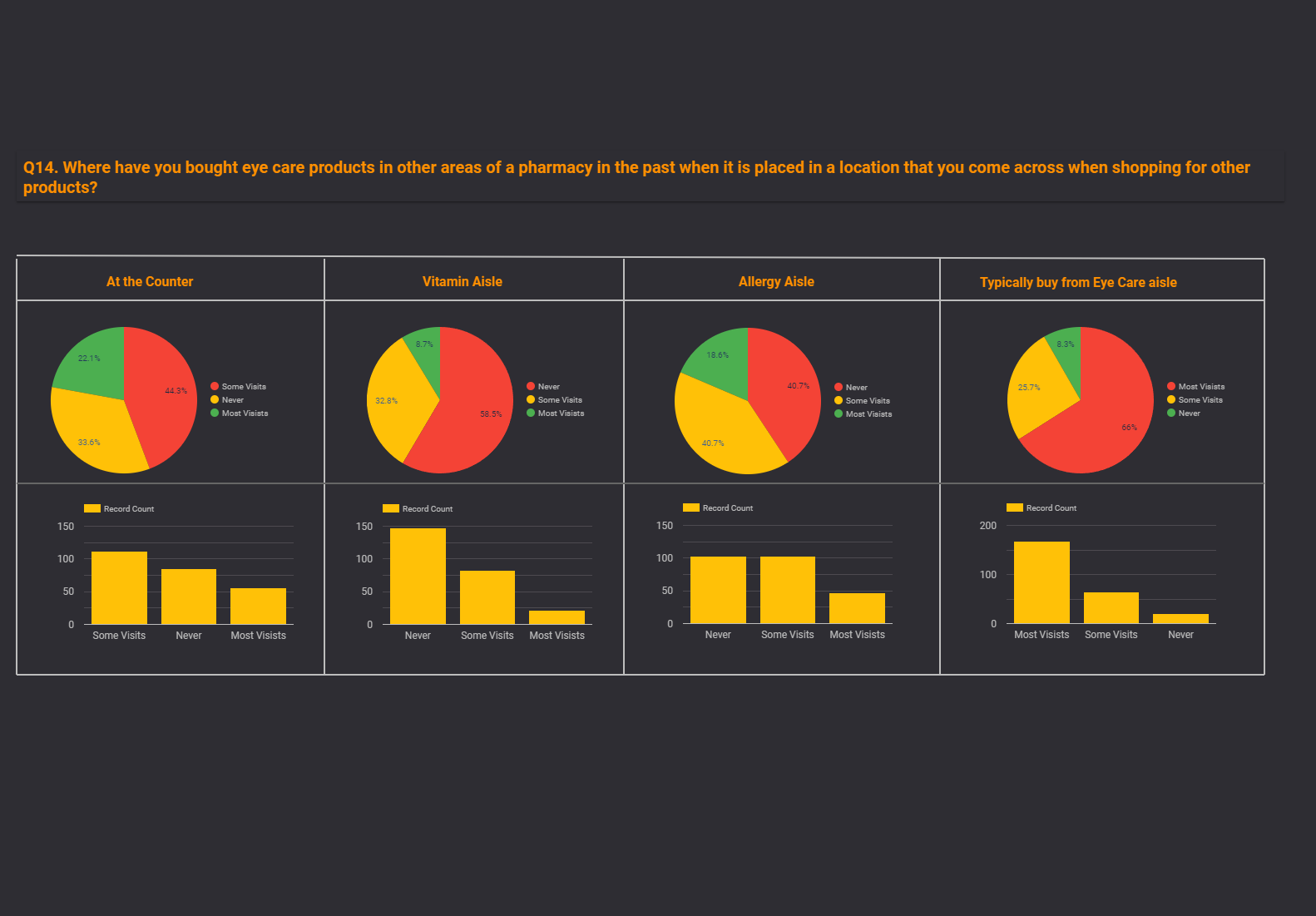

1. Product Visibility: Measure the visibility of products on the virtual shelf. This could include eye-tracking data to determine which products draw the most attention.

2. Click-Through Rate: If this is a digital shelf, track how often shoppers click on or interact with specific products to gauge interest.

3. Purchase Intent: Collect data on whether participants express an intent to purchase a product after viewing it on the virtual shelf.

4. Dwell Time: How long shoppers spend looking at a particular product can indicate their level of interest.

5. Conversion Rate: If the virtual shelf is part of an e-commerce platform, measure the rate at which product views translate into actual purchases.

6. Competitive Analysis: Compare metrics for your products against those of competitors to assess relative performance.

7. Package Attractiveness: Collect feedback on the design, colors, and overall visual appeal of product packaging.

8. Shopper Feedback: Conduct surveys or interviews to gather qualitative insights about the shopping experience and product preferences.

9. Position and Shelf Placement: Analyze the effect of different shelf positions or arrangements on product visibility and sales.

10. Pricing Sensitivity: Assess how price changes influence shopper behavior on the virtual shelf.

11. A/B Testing: Conduct experiments to compare different shelf layouts, product arrangements, or packaging designs to determine the most effective options.

These metrics help businesses understand how consumers interact with products in a virtual retail setting, allowing them to optimize product placement, design, and pricing strategies.

tried & proven methodologies

As pioneers and leaders in virtual research for the retail sector, we anchor our research initiatives in methodologies that are not only tried and proven but also finely tuned to the nuances of consumer behavior. Our approach is deeply rooted in understanding behavior-based cognitive responses, employing the globally recognized System 1 and System 2 framework. This dual-process model allows us to dissect and analyze the quick, instinctive decisions of System 1 alongside the more deliberate and analytical reasoning of System 2, offering you unparalleled insights into the true drivers behind your shoppers’ decisions.

Our commitment to service and support sets us apart in the VR research space. We differentiate ourselves by providing end-to-end support throughout the entire project lifecycle, ensuring that every stage, from initial storytelling to in-depth research, is seamlessly connected. Each phase informs the next, creating a holistic approach that enhances the overall value of your insights.

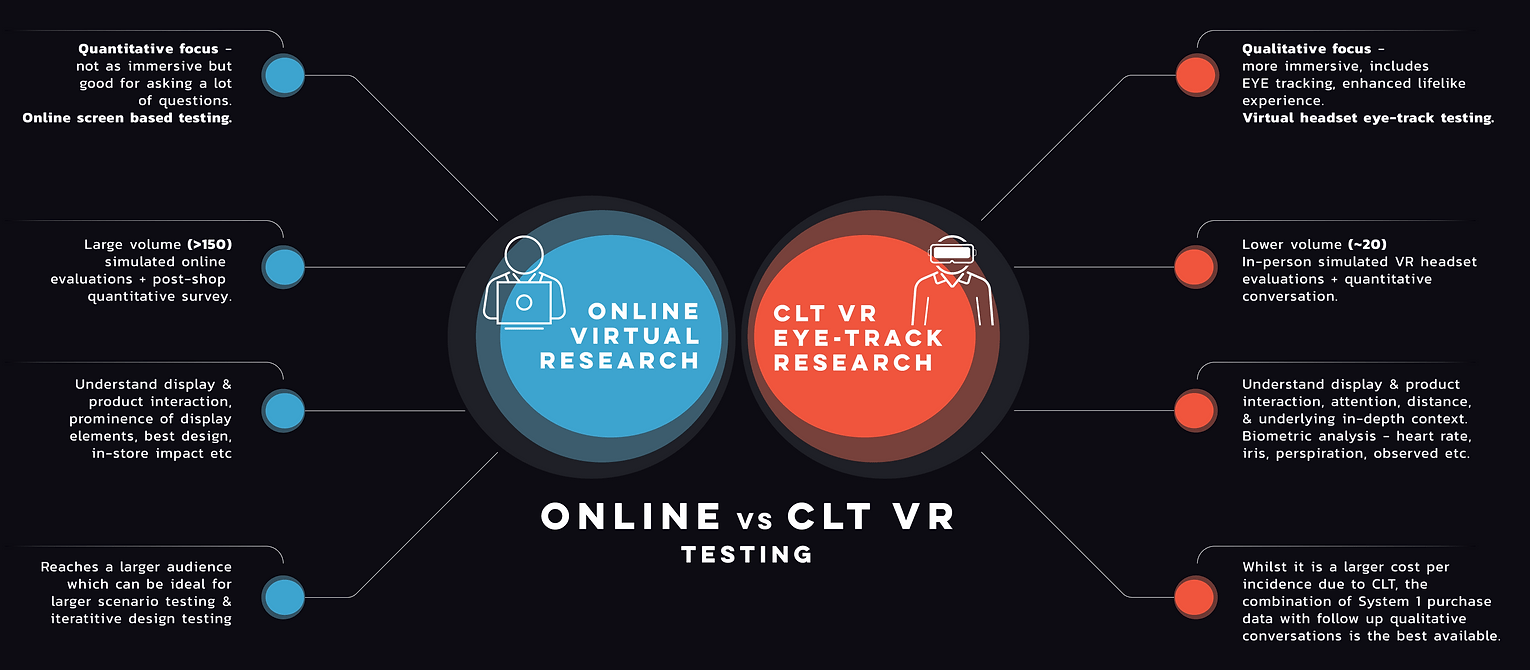

Our cutting-edge VR headset testing, equipped with advanced eye-tracking technology, delivers powerful, real-time data on where and how shoppers focus their attention. However, we recognize that online simulation shops serve as an essential and accessible starting point, offering a scalable and efficient way to understand and continually assess the shopper mindset. By integrating these tools into your research strategy, you can regularly test and refine your understanding of shopper behavior, ultimately driving more informed and effective retail decisions.

What truly amplifies the power of our research is our unparalleled access to a vast and diverse pool of global respondents. With millions of participants from every conceivable demographic, age group, and financial background, we ensure that your research captures a truly representative snapshot of your target market. This extensive reach allows us to deliver insights that are not only statistically significant but also deeply reflective of the global market landscape.

To ensure the robustness and reliability of our findings, every online test we conduct is rigorously backed by qualitative surveys and head-to-head comparisons. These supplementary methods provide a richer context to the quantitative data, allowing for a more nuanced understanding of shopper behaviors and preferences. Whether it’s uncovering subtle differences between market segments or validating hypotheses through direct consumer feedback, our comprehensive approach leaves no stone unturned in the quest for actionable insights.

online virtual

research

(example)

1. Pre-Shop Screener

2. Simulated Shop

3. Post-Shop survey

Shopper hierarchy, effectiveness of layout, signage and recall.

clt virtual

eye-track research

(example)

1. Central location (CLT)

2. Simulated shop - Eye tracking

After the check in procedure, we run all candidates through a ‘de-sensitisation’ process to give the shoppers the feel for the virtual world they are shopping in.

Shoppers can move, shop, inspect, hear and evaluate their purchase in the most life like way possible. We track their movements, their eyes and their entire shop for evaluation.

3. Post-Shop survey / Restrospective think aloud (RTA)

Following the shop, facilitators can guide the respondents through a post shop survey to determine qualitative answers to their experience and choices.

Often, some of our customers also want follow up interviews and walk through a recording of the shop with the respondent, looking at what they looked at to prompt the answers to the ‘why’ they did what they did.

customized reports

to your needs

& budget

We work directly with global research companies, and/or are happy to work with your regions preferred local agencies.

We can also recommend the right niche agency to meet the brief should you not have any preference (i.e. some jobs require neuro-scientists, or some can be done completely in-house and online with templated questions and simplified online report portal).

We have the tech, the experience and the flexibility to meet your budget and time-frame and WE LOVE A CHALLENGE!